Sustainable investing, often referred to as socially responsible investing (SRI) or environmental, social, and governance (ESG) investing, has become a significant force in the financial landscape. This approach to investing goes beyond the traditional focus on financial returns, incorporating environmental, social, and ethical considerations into investment decisions. In this article, we explore the principles, trends, and impact of sustainable investing on both the financial markets and the broader global community.

1. *Understanding Sustainable Investing: A Holistic Approach*

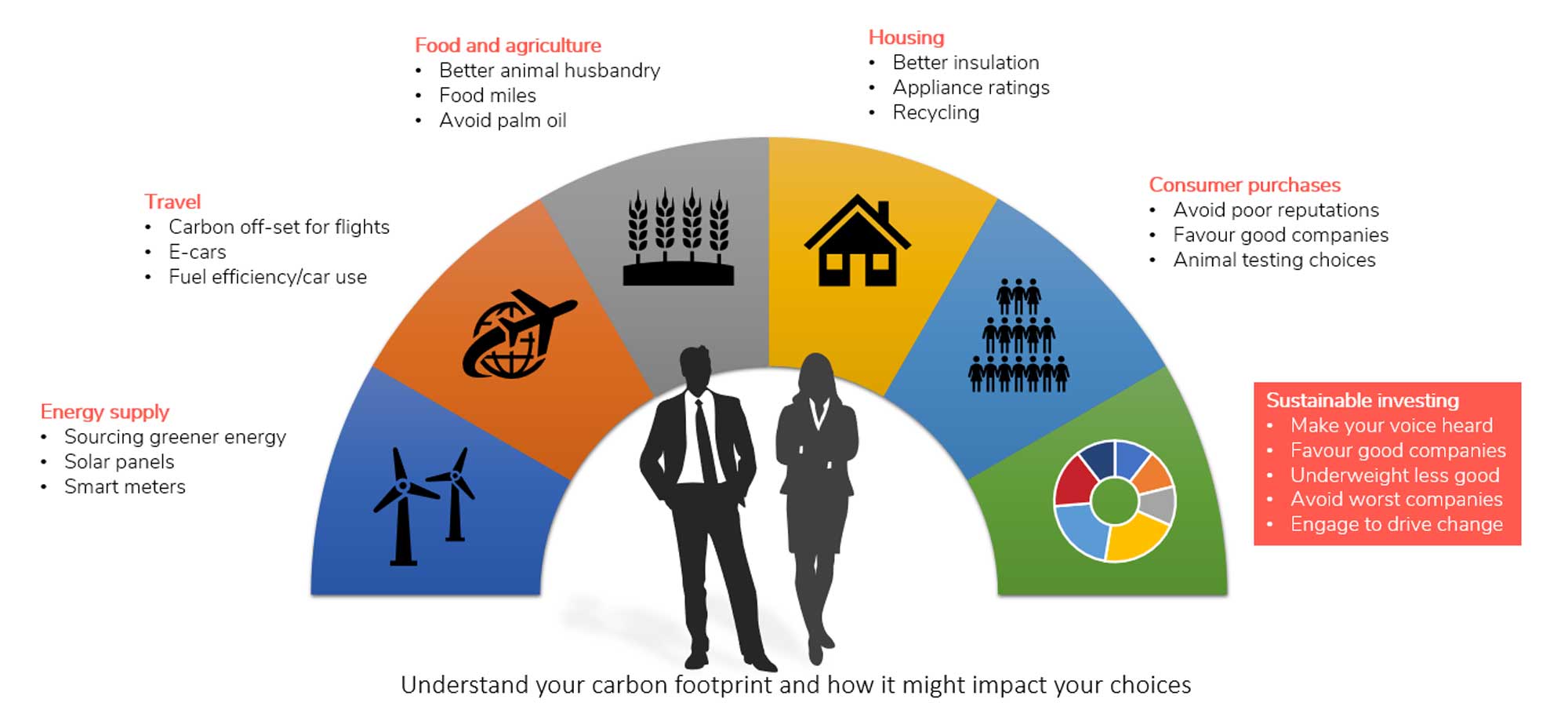

At its core, sustainable investing involves considering not only financial returns but also the broader impact of investments on the planet, society, and corporate governance. Investors who embrace sustainable investing aim to align their portfolios with their values, supporting companies that prioritize environmental stewardship, social responsibility, and ethical governance practices.

2. *Environmental Considerations: Promoting a Greener Future*

Environmental factors are a key pillar of sustainable investing. Investors assess a company’s commitment to environmental sustainability, including its carbon footprint, energy efficiency, and overall environmental impact. Companies embracing renewable energy, waste reduction, and eco-friendly practices often find favor with sustainable investors seeking to contribute to a more sustainable and resilient future.

3. *Social Impact: Fostering Socially Responsible Practices*

Sustainable investing places a strong emphasis on the social dimension of corporate behavior. Investors evaluate how companies address social issues such as labor practices, diversity and inclusion, community engagement, and human rights. Businesses that prioritize fair labor practices, employee well-being, and community development are considered more aligned with sustainable investing principles.

4. *Governance Practices: Upholding Ethical Leadership*

Corporate governance is a critical factor in sustainable investing. Investors assess the ethical standards and transparency of a company’s leadership. Businesses with strong governance practices, including effective board structures, ethical decision-making, and transparency in financial reporting, are viewed as more sustainable investments.

5. *Trends in Sustainable Investing: A Global Movement*

Sustainable investing has evolved from a niche approach to a global movement, with an increasing number of investors recognizing the importance of aligning investments with values. The integration of ESG factors into investment strategies has gained traction across asset classes, from equities and bonds to real estate and private equity.

6. *Financial Performance and Risk Management: Debunking Myths*

Contrary to the misconception that sustainable investing compromises financial returns, numerous studies suggest that companies with strong ESG practices often outperform their counterparts over the long term. Sustainable investing is not just about ethics; it’s a strategic approach that considers the long-term sustainability of both the planet and financial portfolios.

7. *Impact Investing: Blurring the Lines Between Profit and Purpose*

Impact investing takes sustainable investing a step further by actively seeking investments that generate measurable positive social or environmental impact alongside financial returns. This form of investing aims to create positive change on a broader scale, addressing issues such as climate change, poverty, and inequality while delivering competitive financial returns.

8. *Challenges and Opportunities: Navigating the Landscape*

While sustainable investing presents immense opportunities, challenges persist. Standardization of ESG metrics, ensuring greenwashing doesn’t dilute the impact, and addressing the evolving nature of sustainability considerations are key challenges. However, as the demand for sustainable investment options continues to grow, so do opportunities for innovation and positive change within the financial industry.

Conclusion: Investing for a Better Future

Sustainable investing marks a paradigm shift in the world of finance, reflecting a growing awareness of the interconnectedness between financial success and global well-being. As investors increasingly consider the broader impact of their portfolios, the financial industry is reshaping itself to meet the demands of a more conscientious generation. Sustainable investing is not just a trend; it’s a transformation that holds the potential to drive positive change, shaping a future where profit and purpose coexist harmoniously.

Read More : The E-commerce Revolution: Transforming Retail and Reshaping Consumer Behavior

More Stories

How Technology Empowers Modern Law Firms to Work Smarter, Safer, and Faster

Top Finance Careers to Watch in 2024: Pathways to Success

Top Business Degree Jobs in 2024: High-Paying Career Paths for Graduates